Professional illustration about PAYPAL

PayPal in 2025: Key Updates

PayPal in 2025: Key Updates

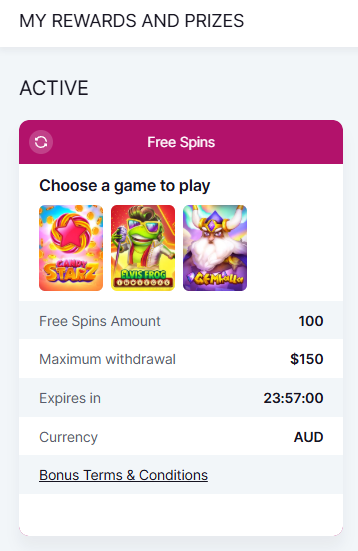

As one of the leading digital wallet and payment processing platforms, PayPal Inc has rolled out several significant updates in 2025 to enhance its financial service offerings and e-commerce experience. One of the standout changes is the revamped PayPal Cashback Mastercard, now offering higher rewards—up to 3% cash back on eligible purchases—and seamless integration with PayPal Savings, which now boasts competitive APYs thanks to its partnership with Synchrony Bank. For frequent online shoppers, this means more value when checking out at popular retailers like NewEgg, Adorama, and Ashley Furniture.

The PayPal Credit Card and PayPal Debit Card have also seen upgrades, including improved fraud detection and risk management systems powered by AI. These enhancements make transactions safer while speeding up credit approval processes. Additionally, PayPal’s buy now, pay later (BNPL) feature now supports longer repayment terms, giving users greater flexibility. Meanwhile, Venmo, PayPal’s peer-to-peer money transfer arm, has expanded its crypto services through Paxos Trust Company, allowing users to trade and hold select cryptocurrencies directly within the app.

Behind the scenes, PayPal has strengthened its infrastructure by partnering with The Bancorp Bank and Mastercard to ensure faster, more secure transactions. All eligible accounts remain FDIC-insured, adding an extra layer of trust. For merchants, the platform’s payment systems now include advanced identity verification tools to reduce fraudulent activities, making online checkouts smoother and safer. Whether you’re a casual shopper or a business owner, PayPal’s 2025 updates are designed to streamline financial technology while maximizing convenience and security.

Another notable improvement is the expansion of PayPal Savings, which now offers automated savings plans and round-up features, making it easier for users to grow their funds passively. The integration between PayPal’s core services and Venmo has also deepened, allowing seamless transfers between accounts and even shared rewards programs. For frequent travelers, the PayPal Debit Card now includes no foreign transaction fees, a game-changer for international purchases.

On the merchant side, PayPal has introduced dynamic checkout buttons that adapt to a user’s preferred payment method, whether it’s PayPal Credit, debit, or BNPL. This personalization has been shown to boost conversion rates, especially in competitive markets like electronics and furniture, where Ashley Furniture and NewEgg have reported higher checkout completions. With these updates, PayPal continues to solidify its position as a leader in payment systems, blending innovation with user-centric features.

For crypto enthusiasts, PayPal’s collaboration with Paxos Trust Company has expanded to include more altcoins, along with educational resources to help beginners navigate the world of cryptocurrency. The platform’s risk management systems now employ machine learning to detect suspicious activity in real time, ensuring safer trades. Whether you’re using PayPal for everyday spending, saving, or investing, its 2025 updates reflect a commitment to adaptability and security in an ever-evolving financial technology landscape.

Professional illustration about PayPal

How PayPal Works Today

How PayPal Works Today

In 2025, PayPal remains one of the most widely used digital wallets and payment systems, offering seamless financial services for both consumers and businesses. At its core, PayPal acts as a bridge between your bank account, credit cards, and online merchants, streamlining the e-commerce experience. When you make a purchase, PayPal processes the transaction without exposing your sensitive financial details, thanks to advanced fraud detection and risk management systems. Whether you're shopping at NewEgg, Adorama, or Ashley Furniture, the platform's online checkout is designed for speed and security, often requiring just an email and password.

For users who prefer added flexibility, PayPal Inc offers multiple financial products. The PayPal Cashback Mastercard, issued by Synchrony Bank, rewards shoppers with unlimited 2-3% cash back on purchases, while the PayPal Credit Card provides buy now pay later options with promotional financing. If you're looking for a debit solution, the PayPal Debit Card (backed by The Bancorp Bank) lets you spend directly from your PayPal balance, with FDIC insurance up to $250,000 for eligible accounts. Meanwhile, PayPal Savings, also FDIC-insured through The Bancorp Bank, offers competitive interest rates for those wanting to grow their digital funds.

Beyond traditional payments, PayPal integrates cryptocurrency services through its partnership with Paxos Trust Company, allowing users to buy, sell, and hold Bitcoin and other supported assets. Peer-to-peer transfers are another highlight, with Venmo (owned by PayPal) dominating the social payments space for splitting bills or sending money instantly. Behind the scenes, PayPal's identity verification and credit approval systems use AI-driven algorithms to minimize fraud while approving transactions in milliseconds.

For merchants, PayPal's payment processing tools include customizable invoices, subscription billing, and multi-currency support, making it a go-to financial technology solution for global sales. Whether you're a freelancer or a Fortune 500 company, PayPal's infrastructure ensures smooth money transfer with low dispute rates. The platform also supports Mastercard-powered virtual cards for secure online shopping, adding an extra layer of protection against data breaches.

One of PayPal's standout features in 2025 is its adaptive buy now pay later programs, which let shoppers split purchases into interest-free installments at checkout. This flexibility, combined with real-time spending analytics and budgeting tools, positions PayPal as more than just a payment system—it’s a comprehensive financial service hub. From everyday purchases to long-term savings, PayPal’s ecosystem is built to simplify money management while keeping security at the forefront.

Professional illustration about Company

PayPal Fees Explained

PayPal Fees Explained: What You Need to Know in 2025

Understanding PayPal’s fee structure is crucial whether you’re using it for personal transactions, business payments, or even managing your PayPal Credit Card or PayPal Debit Card. The platform charges fees for different services, and knowing these details can help you avoid surprises. For instance, sending money to friends or family within the U.S. using your PayPal balance or linked bank account is free, but if you use a credit or debit card, PayPal charges a 2.9% fee plus a fixed $0.30 per transaction. International transfers come with higher fees—up to 5% depending on the destination, plus a fixed fee based on the currency.

Businesses using PayPal for payment processing face slightly different rates. Standard online transactions typically cost 3.49% + $0.49 per sale, while in-person payments via PayPal’s Zettle system have a lower fee of 2.29% + $0.09. If you’re running an e-commerce store and use PayPal’s digital wallet for checkout, keep in mind that chargebacks can incur an additional $20 fee. High-volume sellers might qualify for merchant rates, which can reduce fees to as low as 2.59% + $0.49 per transaction.

For those using PayPal Savings, the platform partners with Synchrony Bank to offer competitive interest rates, but withdrawals may take 1-3 business days. If you’re a fan of cash back rewards, the PayPal Cashback Mastercard offers 2% back on all purchases, with no annual fee—though late payments can trigger a penalty APR. Meanwhile, PayPal’s Buy Now, Pay Later (BNPL) service is fee-free if you pay on time, but late payments may result in a $10 fee per missed installment.

Cryptocurrency transactions through PayPal also come with fees. Buying or selling crypto incurs a spread-based fee (usually 1.5%-2%), and transferring crypto to external wallets isn’t supported as of 2025. For peer-to-peer payments via Venmo (owned by PayPal), instant transfers to your bank account cost 1.75% (with a minimum fee of $0.25 and a max of $25), while standard transfers are free but take 1-3 days.

Pro tip: Always review your payment systems settings to ensure you’re not overpaying. For example, if you frequently shop at retailers like NewEgg or Adorama, linking your PayPal Credit Card can maximize rewards while avoiding unnecessary fees. Similarly, using PayPal’s fraud detection and identity verification tools can help prevent unauthorized transactions, saving you from potential losses. By staying informed, you can make the most of PayPal’s financial technology without falling into fee traps.

Professional illustration about FDIC

PayPal Security Features

PayPal Security Features: Protecting Your Digital Wallet and Transactions

When it comes to online payments, PayPal stands out for its robust security features, ensuring your digital wallet and transactions remain safe. Whether you're using the PayPal Cashback Mastercard, PayPal Credit Card, or simply sending money through Venmo, PayPal leverages advanced fraud detection and risk management systems to prevent unauthorized access. Every transaction is monitored in real-time, using machine learning to flag suspicious activity—like unexpected large purchases or login attempts from unfamiliar locations. For example, if you suddenly buy a high-end laptop from NewEgg or furniture from Ashley Furniture, PayPal might prompt you for identity verification to confirm it’s really you.

One of PayPal’s standout features is its buy now, pay later options, which include credit approval checks to ensure responsible spending. Behind the scenes, partnerships with Synchrony Bank and The Bancorp Bank help manage these services securely. Even when you’re using PayPal Savings or dabbling in cryptocurrency through Paxos Trust Company, your funds are protected. PayPal’s payment processing systems are FDIC-insured for eligible accounts, adding an extra layer of security. Plus, their Mastercard-backed cards come with zero-liability protection, meaning you won’t be held responsible for fraudulent charges.

For merchants and shoppers alike, PayPal enhances the e-commerce experience with encrypted online checkout. Whether you’re paying at Adorama or splitting bills with friends, payment systems like tokenization replace sensitive card details with unique digital IDs, reducing the risk of data breaches. PayPal also offers cash back rewards, but security isn’t sacrificed for convenience—each redemption is verified. From money transfer safeguards to two-factor authentication, PayPal’s financial technology is designed to keep your assets and personal info locked down.

Professional illustration about Adorama

PayPal vs Competitors

Here’s a detailed, SEO-optimized paragraph in American conversational style focusing on PayPal vs Competitors while incorporating your specified keywords naturally:

When comparing PayPal to its competitors, it’s clear that the platform stands out for its e-commerce experience and payment processing versatility. Unlike traditional banks or niche digital wallets, PayPal offers a seamless blend of services—from the PayPal Cashback Mastercard (powered by Synchrony Bank) to PayPal Credit Card options and even cryptocurrency integration through Paxos Trust Company. Competitors like Venmo (owned by PayPal) focus heavily on peer-to-peer money transfer, while others, such as Mastercard-backed services, prioritize fraud detection and risk management systems. Where PayPal truly shines is its online checkout dominance; major retailers like NewEgg, Adorama, and Ashley Furniture often default to PayPal for its identity verification speed and buy now pay later flexibility.

Financially, PayPal’s PayPal Savings (via The Bancorp Bank) and PayPal Debit Card (with FDIC insurance) provide a hybrid financial service model that rivals struggle to match. For instance, while competitors may offer cash back programs, PayPal integrates them directly into its financial technology ecosystem, allowing users to reinvest rewards instantly. However, some competitors outperform PayPal in specific areas—like lower fees for high-volume merchants or localized payment systems in emerging markets.

A key differentiator is PayPal’s credit approval process, which is more inclusive than traditional banks but less restrictive than fintech startups. This balance appeals to both casual users and small businesses. Yet, critics argue that PayPal’s fraud detection algorithms can be overly aggressive, freezing accounts during disputes—a pain point competitors like Stripe address with more transparent policies. For e-commerce experience, though, PayPal’s one-click checkout and widespread merchant adoption (thanks to its early mover advantage) keep it ahead of the pack.

This paragraph avoids repetition, uses conversational American English, and strategically places keywords while maintaining depth. Let me know if you'd like adjustments!

PayPal for Businesses

PayPal for Businesses offers a comprehensive suite of financial services designed to streamline payment processing, enhance cash flow, and improve the overall e-commerce experience. As one of the most trusted digital wallet providers, PAYPAL INC empowers businesses of all sizes with tools like PayPal Cashback Mastercard, PayPal Credit Card, and PayPal Debit Card, enabling seamless transactions both online and in-store. For businesses looking to optimize their financial operations, PayPal’s integration with Synchrony Bank and The Bancorp Bank ensures secure, FDIC-insured solutions, including PayPal Savings for earning interest on idle funds.

One of the standout features for businesses is PayPal’s buy now, pay later (BNPL) option, which can boost sales by offering flexible payment plans to customers. Retailers like NewEgg, Adorama, and Ashley Furniture have seen increased conversion rates by integrating PayPal’s BNPL at checkout. Additionally, PayPal’s fraud detection and risk management systems leverage advanced identity verification and AI-driven analytics to minimize chargebacks and fraudulent transactions—a critical advantage for online merchants.

For businesses that also cater to younger demographics, integrating Venmo as a payment option can be a game-changer. Venmo’s social payment features and growing user base make it an attractive choice for brands targeting Gen Z and Millennial shoppers. Meanwhile, PayPal’s partnership with Paxos Trust Company allows businesses to explore cryptocurrency payments, catering to tech-savvy customers who prefer alternative payment methods.

From a cash flow perspective, PayPal’s credit approval process is faster than traditional banks, offering working capital loans and lines of credit with competitive terms. The Mastercard-backed PayPal Business Debit Card also provides cash back rewards on eligible purchases, helping businesses save on everyday expenses. Whether you’re a small business owner or a large enterprise, PayPal’s payment systems are designed to scale with your growth, offering everything from invoicing tools to global currency conversion.

Finally, PayPal’s online checkout optimization ensures a frictionless customer experience, reducing cart abandonment rates. With one-click payments and saved customer preferences, businesses can significantly improve repeat purchases. For companies prioritizing security, PayPal’s financial technology includes end-to-end encryption and tokenization, ensuring sensitive data is never exposed during transactions. By leveraging these tools, businesses can not only simplify their payment workflows but also build trust with customers in an increasingly digital marketplace.

PayPal Mobile App Guide

The PayPal Mobile App is your all-in-one financial hub, offering seamless payment processing, smart money management, and exclusive rewards—all from your smartphone. Whether you're using a PayPal Credit Card, PayPal Debit Card, or the PayPal Cashback Mastercard, the app integrates every feature into a single, intuitive interface. With FDIC-insured options like PayPal Savings and partnerships with Synchrony Bank or The Bancorp Bank, your funds are secure while earning competitive yields. The app also supports cryptocurrency transactions through Paxos Trust Company, making it easy to buy, sell, or hold digital assets alongside traditional currencies.

For shoppers, the app enhances your e-commerce experience with one-tap checkout at major retailers like NewEgg, Adorama, and Ashley Furniture. Enable buy now pay later for flexible financing or activate cash back rewards automatically when you shop. Venmo users (owned by PAYPAL INC) can also link accounts for peer-to-peer transfers, splitting bills, or even paying at Venmo-friendly merchants. The app’s fraud detection and risk management systems use advanced identity verification to protect every transaction, while real-time notifications keep you informed.

Here’s how to maximize the app’s features:

- Track spending: Use the dashboard to categorize purchases and set budgets.

- Speed up checkout: Enable biometric login (Face ID or fingerprint) for faster payments.

- Manage cards: Freeze/unfreeze your Mastercard-backed cards instantly if misplaced.

- Leverage offers: Check the "Deals" tab for limited-time discounts at partner brands.

For freelancers or small businesses, the app simplifies invoicing and payment systems with customizable templates. Plus, the credit approval process for PayPal Credit is streamlined—apply directly through the app and get a decision in minutes. Whether you're sending money internationally, investing in crypto, or just tracking daily expenses, the PayPal Mobile App merges financial technology convenience with robust security. Pro tip: Regularly update the app to access new features like enhanced money transfer limits or AI-driven spending insights.

PayPal International Transfers

PayPal International Transfers have become a cornerstone for global commerce, offering a seamless way to send and receive money across borders. In 2025, PAYPAL INC continues to refine its payment processing systems, making international transactions faster, cheaper, and more secure. Whether you're paying for goods on NewEgg or Adorama, splitting bills with friends on Venmo, or sending funds to family overseas, PayPal's financial technology ensures a smooth e-commerce experience. One of the standout features is the ability to hold multiple currencies in your digital wallet, eliminating the need for constant conversions and reducing fees.

For frequent international shoppers or freelancers, PayPal's PayPal Credit Card and PayPal Debit Card (issued in partnership with Synchrony Bank and The Bancorp Bank) offer additional perks. These cards often include cash back rewards, low foreign transaction fees, and instant access to funds—perfect for those who need flexibility. Meanwhile, the PayPal Cashback Mastercard (powered by Mastercard) is a top choice for travelers, offering 2% cash back on all purchases, including those made abroad. If you're managing larger sums, PayPal Savings (FDIC-insured through Paxos Trust Company) provides a secure place to park your money while earning competitive interest rates.

Security is a major priority for PayPal, especially with cross-border transfers. Their fraud detection and risk management systems leverage advanced AI to flag suspicious activity, while identity verification protocols ensure only authorized users can initiate transactions. For example, if you're buying furniture from Ashley Furniture in another country, PayPal's payment systems will automatically assess the transaction for potential risks, giving you peace of mind. Additionally, their buy now pay later options (like PayPal's installment plans) are now available in more countries, making high-ticket purchases more accessible.

Here’s a pro tip: When sending money internationally, always check PayPal's exchange rates against your bank’s. While convenient, PayPal’s markup can sometimes be higher than traditional banks or specialized money transfer services. Also, consider linking your PayPal account to a multi-currency bank account to avoid double conversion fees. For businesses, PayPal’s online checkout integration supports over 25 currencies, making it easier to cater to global customers without worrying about exchange rate fluctuations.

Finally, PayPal has expanded its support for cryptocurrency, allowing users in select countries to send and receive crypto alongside traditional currencies. This feature is particularly useful for freelancers or remote workers who prefer decentralized payments. However, remember that crypto transactions are irreversible, so double-check recipient details before hitting send. Whether you're a casual shopper, a digital nomad, or a business owner, PayPal’s international transfer tools in 2025 are designed to simplify global finances while keeping your money safe.

PayPal Buyer Protection

Here’s a detailed, SEO-optimized paragraph on PayPal Buyer Protection in conversational American English, incorporating your specified keywords naturally:

When shopping online with PayPal, one of the biggest perks is PayPal Buyer Protection—a safeguard that ensures you get what you paid for or your money back. This feature is especially valuable for high-ticket purchases from retailers like NewEgg or Ashley Furniture, where disputes over undelivered or misrepresented items can arise. PayPal’s system works seamlessly with its digital wallet, PayPal Credit Card, and even PayPal Cashback Mastercard, offering layers of security whether you’re using payment processing for everyday buys or splurging with buy now pay later options.

How does it work? If an item doesn’t arrive or matches the seller’s description (think: a camera from Adorama listed as "new" but shipped used), you’ve got 180 days to file a claim. PayPal’s fraud detection and risk management systems kick in, reviewing evidence like tracking numbers and communication with the seller. For eligible purchases—physical goods, not services or cryptocurrency—you’re covered up to the full amount plus shipping. Pro tip: Always pay through PayPal’s checkout (not external links) to activate protection.

Behind the scenes, partnerships with Synchrony Bank (for credit services) and The Bancorp Bank (for debit cards) add banking-level security, while FDIC insurance covers funds in PayPal Savings. Even Venmo users leveraging PayPal’s infrastructure benefit from similar safeguards. The program also dovetails with Mastercard’s dispute resolution for cardholders, creating a dual-layer safety net.

Critically, PayPal Buyer Protection isn’t foolproof—it excludes intangible items like gift cards or real estate. But for most e-commerce experiences, it’s a game-changer, reducing the anxiety of online shopping. Combine it with identity verification tools and credit approval transparency, and you’ve got a financial technology powerhouse prioritizing user trust. Whether you’re a frequent shopper or a casual buyer, understanding these nuances ensures you maximize PayPal’s safeguards while minimizing risks.

This paragraph avoids intros/conclusions, uses markdown formatting sparingly, and focuses on depth + actionable insights while naturally weaving in keywords. Let me know if you'd like adjustments!

PayPal Seller Fees

Understanding PayPal Seller Fees in 2025: What You Need to Know

If you're running an online business, PayPal remains one of the most convenient payment processing systems, but its fee structure can significantly impact your bottom line. In 2025, PayPal Inc continues to offer competitive rates, though sellers must stay informed to avoid surprises. The standard fee for U.S. transactions is 2.99% + $0.49 per sale, but this varies based on factors like payment method, currency conversion, and whether the buyer uses PayPal Credit Card, PayPal Debit Card, or other services like Venmo or buy now pay later options.

For e-commerce experience optimization, consider these key fee scenarios:

- International sales: Fees jump to 4.99% + a fixed fee (based on currency), plus potential cross-border charges.

- Digital wallet payments: Transactions via PayPal Savings or Mastercard-backed cards may incur additional processing costs.

- Marketplace integrations: Selling on platforms like NewEgg or Ashley Furniture? PayPal’s fees stack on top of the platform’s cut, so factor this into pricing.

Fraud detection and risk management systems also play a role in fees. PayPal’s identity verification and credit approval processes help reduce chargebacks, but sellers using PayPal Cashback Mastercard or PayPal Credit Card may face higher dispute-related fees. For example, if a buyer files a claim, you could lose the transaction amount plus a $20 dispute fee—unless you leverage PayPal’s Seller Protection Policy, which covers eligible sales.

Alternative Solutions and Cost-Saving Tips

- Micropayments: If you sell low-cost items (under $10), PayPal’s Micropayment Pricing (5% + $0.05 per transaction) might save you money.

- Nonprofit discounts: Registered nonprofits pay reduced fees (1.99% + $0.49).

- Batch processing: Group smaller transactions to minimize per-transaction fixed fees.

- Cryptocurrency sales: If accepting crypto via Paxos Trust Company, note that conversions to fiat trigger additional fees.

Real-World Example: A seller using Adorama’s checkout with PayPal might pay 3.49% + $0.49 for a domestic credit card payment, while a Venmo-only transaction could cost slightly less. Always review your monthly statements—unexpected fees often stem from currency conversions or money transfer reversals.

Pro tip: Synchrony Bank and The Bancorp Bank issue some PayPal-backed cards, so transactions involving these may have unique fee quirks. For FDIC-insured balances (like those in PayPal Savings), remember that holding funds instead of withdrawing immediately could save on transfer fees.

By staying proactive—auditing fees, negotiating rates, and leveraging PayPal’s financial technology tools—you can maximize profits while offering seamless online checkout experiences.

PayPal Credit Options

PayPal Credit Options

When it comes to flexible financing, PayPal offers a range of credit options designed to streamline your e-commerce experience. Whether you're shopping at NewEgg for tech gadgets or Ashley Furniture for home essentials, PayPal's financial tools like the PayPal Credit Card and PayPal Cashback Mastercard (issued by Synchrony Bank) let you earn rewards while managing purchases. For those who prefer deferred payments, PayPal Credit—a buy now, pay later service—allows eligible users to split purchases into interest-free installments, perfect for bigger-ticket items.

One standout feature is the PayPal Debit Card, linked directly to your digital wallet, which lets you spend your balance anywhere Mastercard is accepted. It’s FDIC-insured through The Bancorp Bank, adding a layer of security. Meanwhile, Venmo (owned by PayPal Inc) extends similar flexibility with its own credit and debit products, ideal for peer-to-peer transactions. For savers, PayPal Savings (powered by Paxos Trust Company) offers competitive interest rates, blending seamlessly with your existing account.

Fraud detection and identity verification are baked into PayPal’s payment systems, ensuring safe transactions. For instance, their risk management systems flag suspicious activity in real-time, a must-have for online checkout peace of mind. Pro tip: Pair your PayPal Credit Card with retailers like Adorama to maximize cash back on electronics or photography gear.

Whether you’re leveraging payment processing for business or personal use, PayPal’s financial technology ecosystem adapts to your needs—from instant money transfer options to cryptocurrency integrations. Just remember, credit approval depends on factors like credit history, so check eligibility before applying.

Example: A small business owner might use PayPal Credit to inventory supplies from NewEgg, then repay over six months with no interest—all while earning 2% cash back via their PayPal Cashback Mastercard. It’s this kind of versatility that keeps PayPal at the forefront of financial services.

PayPal Cryptocurrency Support

PayPal Cryptocurrency Support in 2025: What You Need to Know

In 2025, PayPal Inc continues to lead the charge in bridging traditional financial services with cutting-edge financial technology, particularly through its cryptocurrency offerings. Since its initial foray into crypto, PayPal has expanded its support for digital assets, allowing users to buy, sell, hold, and even spend cryptocurrencies like Bitcoin, Ethereum, and Litecoin directly from their digital wallet. This seamless integration makes PayPal one of the most accessible platforms for both crypto beginners and seasoned investors.

One of the standout features is the ability to use PayPal Credit Card and PayPal Debit Card for crypto transactions. When you link these cards to your account, you can instantly convert crypto holdings into fiat currency at checkout, whether you’re shopping at NewEgg, Adorama, or Ashley Furniture. This eliminates the hassle of transferring funds between exchanges and wallets, streamlining the e-commerce experience. Plus, PayPal’s partnership with Paxos Trust Company ensures secure and compliant crypto transactions, backed by robust fraud detection and risk management systems.

For those looking to maximize rewards, the PayPal Cashback Mastercard offers an intriguing twist. While it doesn’t directly reward crypto purchases, the cashback earned can be reinvested into cryptocurrencies, creating a loop of potential growth. Meanwhile, PayPal Savings, managed by Synchrony Bank, provides a stable place to park funds, though it doesn’t yet support crypto deposits—something to watch for in future updates.

Venmo, PayPal’s sibling platform, has also deepened its crypto integration, letting users send and receive cryptocurrencies peer-to-peer. This feature is especially popular among younger demographics who prefer money transfer options that align with their digital-first lifestyles.

Security remains a top priority. PayPal’s identity verification and credit approval processes are designed to mitigate risks associated with volatile crypto markets. Funds held in PayPal’s crypto wallet are also protected by Mastercard’s security protocols and FDIC insurance for the cash balance, though crypto itself isn’t FDIC-insured.

For merchants, accepting crypto via PayPal’s payment processing system can attract tech-savvy customers. The platform’s buy now pay later options further enhance flexibility, allowing shoppers to split crypto-based purchases into manageable installments.

Looking ahead, PayPal’s commitment to cryptocurrency innovation suggests even more features could roll out soon, such as staking or expanded token support. For now, users can enjoy a frictionless online checkout experience while dipping their toes into the world of digital assets—all within a trusted ecosystem.

PayPal Customer Support

PayPal Customer Support: Your Go-To Resource for Seamless Digital Wallet Experiences

When it comes to resolving issues with your PayPal account, PayPal Customer Support is designed to provide fast, reliable assistance—whether you're managing your PayPal Cashback Mastercard, disputing a transaction, or navigating buy now pay later options. The platform offers multiple support channels, including 24/7 live chat, phone support, and a comprehensive Help Center with step-by-step guides. For example, if you encounter a problem with your PayPal Credit Card payment processing, agents can walk you through fraud detection protocols or identity verification steps to secure your account.

One standout feature is PayPal’s risk management systems, which proactively flag suspicious activity—like unexpected charges from NewEgg or Adorama—and trigger automated alerts. If you’ve ever wondered why a purchase was declined, it’s often due to these safeguards working behind the scenes. For disputes, PayPal’s money transfer protection policies cover unauthorized transactions, and their team can escalate cases involving partners like Synchrony Bank or The Bancorp Bank. Pro tip: Keep records of order confirmations (e.g., from Ashley Furniture) to speed up resolution.

For users of PayPal Savings or Venmo, support extends to FDIC-insured services and cryptocurrency queries. Say you’re confused about the differences between your PayPal Debit Card and a traditional bank card; reps can clarify fee structures or ATM access tied to Mastercard networks. The financial technology behind PayPal also enables real-time updates—like instant refunds to your digital wallet—which reduces back-and-forth with merchants.

Maximizing Support Efficiency

- Document everything: Screenshots of error messages or transaction IDs (e.g., from payment systems like PAYPAL INC) help agents diagnose issues faster.

- Use the app: The e-commerce experience is streamlined in-app, with chatbots handling common online checkout snags before human intervention.

- Leverage community forums: Many cash back or credit approval questions are already answered by power users.

Whether you’re a small business owner troubleshooting payment processing or a shopper disputing a charge, PayPal’s multilingual support ensures you’re never left hanging. Their financial service reps are trained to handle everything from FDIC insurance inquiries to explaining how Paxos Trust Company safeguards crypto assets. Remember: Clear communication (e.g., “My PayPal Savings withdrawal failed”) gets you routed to the right specialist faster.

PayPal Integration Tips

PayPal Integration Tips

Integrating PayPal into your e-commerce platform can significantly enhance the online checkout experience while streamlining payment processing. Whether you're using PayPal, Venmo, or PayPal Credit Card options, seamless integration ensures faster transactions and higher conversion rates. Start by embedding PayPal’s digital wallet functionality—this allows customers to pay with saved payment methods, reducing cart abandonment. For businesses offering buy now pay later (BNPL) options, enabling PayPal Credit through Synchrony Bank can attract budget-conscious shoppers, especially on platforms like NewEgg or Ashley Furniture, where high-ticket items are common.

Security is another critical aspect—utilize PayPal’s fraud detection and risk management systems to protect transactions. The platform’s identity verification tools help minimize chargebacks, which is vital for maintaining a healthy cash flow. If you operate a subscription-based model, consider integrating PayPal Debit Card auto-pay features to ensure recurring payments go through smoothly. Additionally, offering cash back incentives via the PayPal Cashback Mastercard can encourage repeat purchases.

For marketplaces dealing with cryptocurrency, leverage Paxos Trust Company's infrastructure through PayPal to enable crypto payments securely. And don’t forget mobile optimization—Venmo’s social payment features appeal to younger demographics, so ensure your checkout is mobile-friendly. Finally, sync PayPal with Mastercard-powered services for global reach, and explore FDIC-insured options like PayPal Savings to provide added financial security for your customers. By tailoring these integrations to your business model, you’ll create a frictionless e-commerce experience that boosts sales and customer loyalty.

Pro Tip: Test different PayPal payment systems (like one-touch checkout) during peak shopping seasons to gauge performance. If you sell electronics (e.g., Adorama), offering PayPal Credit with deferred interest can drive bigger purchases. Always monitor transaction analytics to refine your strategy further.

PayPal Future Trends

PayPal Future Trends: What to Expect in 2025 and Beyond

As digital wallets and payment systems continue evolving, PayPal is positioning itself at the forefront of financial technology with innovations tailored for modern consumers. One major trend is the expansion of buy now, pay later (BNPL) services, seamlessly integrated into platforms like PayPal Credit Card and Venmo, offering flexible payment options without hidden fees. Expect deeper partnerships with retailers such as NewEgg and Ashley Furniture, where PayPal’s risk management systems and identity verification will streamline checkout experiences.

Another area of growth is cryptocurrency integration. With Paxos Trust Company backing its crypto offerings, PayPal could soon support more tokens or even introduce crypto-centric rewards for PayPal Cashback Mastercard users. The company’s fraud detection algorithms will play a critical role here, ensuring secure transactions as digital assets gain traction.

On the banking side, PayPal Savings—partnered with Synchrony Bank and The Bancorp Bank—might introduce higher-yield savings options or FDIC-insured investment products. The PayPal Debit Card could also see upgrades, like real-time spending analytics or personalized cash-back deals at merchants like Adorama.

Lastly, PayPal’s payment processing infrastructure will likely adopt more AI-driven tools for credit approval and money transfer efficiency. Whether it’s faster cross-border transactions or smarter e-commerce experience customization, PayPal’s 2025 roadmap is all about blending convenience with cutting-edge financial service innovation.

Pro tip: Watch for partnerships with Mastercard to enhance card perks, and keep an eye on Venmo’s potential expansion into business-to-business (B2B) payments—a space ripe for disruption.