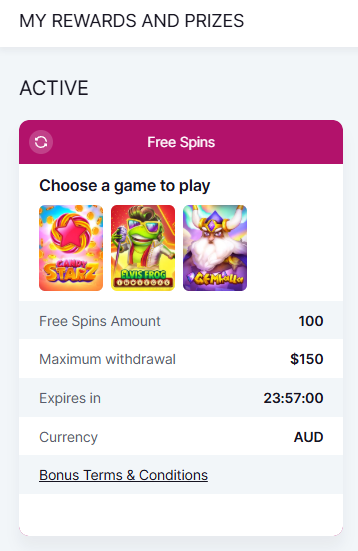

Professional illustration about Bitcoin

Bitcoin in 2025: Trends

Bitcoin in 2025: Trends

The Bitcoin landscape in 2025 is shaped by a mix of technological advancements, regulatory shifts, and evolving market dynamics. One of the most notable trends is the growing institutional adoption, with companies like MicroStrategy continuing to double down on their Bitcoin holdings as a hedge against inflation. This corporate embrace has solidified Bitcoin’s role as "digital gold," especially amid global economic uncertainties. Meanwhile, Bitcoin mining remains a hot topic, with debates around energy consumption and mining regulation intensifying. Countries with cheap renewable energy, like those in Scandinavia, are attracting more miners, while regions with strict mining bans (such as parts of China) have seen a decline in activity.

The mining competition has also reached new heights, with larger players dominating the space due to economies of scale. Smaller miners are increasingly turning to Bitcoin mining communities (like those on Bitcoin Mining Discord or Bitcoin Mining Forum) to pool resources and stay competitive. The mining cost has risen significantly, driven by higher hardware prices and electricity rates, but innovations in ASIC efficiency are helping offset some of these expenses. For those looking to enter the space, Bitcoin mining courses and Bitcoin mining books have become invaluable resources, offering strategies to maximize mining profit amid fluctuating mining revenue.

On the regulatory front, mining tax policies are becoming more defined, with governments recognizing Bitcoin mining as a taxable industry. Some jurisdictions are even offering incentives, such as tax breaks for miners using renewable energy, to attract businesses. The Bitcoin Core development team continues to push updates aimed at improving scalability and security, though debates around Proof of Work versus alternative consensus mechanisms persist. Environmental concerns remain a sticking point, but the industry is responding with greener solutions, including carbon-neutral mining operations.

Social media platforms like Bitcoin Mining Facebook and dedicated Bitcoin mining feeds are buzzing with real-time discussions on market trends, hardware reviews, and profitability calculators. The Bitcoin Mining Alert services have also gained traction, providing miners with instant updates on network difficulty adjustments or potential outages. For deeper insights, many turn to Bitcoin mining analysis blogs, which break down complex metrics like hash rate fluctuations and their impact on mining incentives.

From a trading perspective, cryptocurrency exchanges are seeing record trading volumes, particularly around Bitcoin halving events, which historically trigger bull runs. The integration of Bitcoin into traditional finance (like spot ETFs) has further legitimized the asset, drawing in retail and institutional investors alike. However, volatility remains a constant, with macroeconomic factors—such as interest rate changes or geopolitical tensions—swiftly impacting prices.

In summary, Bitcoin in 2025 is a story of maturation: institutional adoption is rising, mining is becoming more regulated (and competitive), and the blockchain ecosystem is evolving to address scalability and sustainability. Whether you're a miner, trader, or long-term holder, staying informed through Bitcoin mining communities and expert analyses is key to navigating this dynamic space.

Professional illustration about MicroStrategy

How Bitcoin Works

How Bitcoin Works

At its core, Bitcoin operates on a decentralized blockchain network, where transactions are verified and recorded by a global network of nodes. Unlike traditional banking systems, Bitcoin eliminates intermediaries by relying on Proof of Work (PoW) consensus. Miners compete to solve complex mathematical puzzles, and the first to succeed earns the right to add a new block to the blockchain, receiving Bitcoin mining rewards in return. This process, known as Bitcoin mining, ensures security and transparency while maintaining the integrity of the ledger. However, it also raises concerns about energy consumption, as the computational power required is substantial. Companies like MicroStrategy have invested heavily in Bitcoin, recognizing its potential as a store of value, while the Bitcoin mining community continues to grow, with forums and Discord groups dedicated to sharing strategies and updates.

The Bitcoin Core software is the backbone of the network, enabling users to run full nodes that validate transactions and blocks. Every transaction is broadcast to the network, where miners bundle them into blocks. The mining competition is fierce, with participants constantly upgrading hardware to stay profitable amid fluctuating mining costs and mining revenue. Factors like mining regulation and mining tax policies can significantly impact profitability, leading miners to seek jurisdictions with favorable conditions. Meanwhile, the Bitcoin mining feed on platforms like Facebook and specialized blogs provide real-time insights into hash rate changes, mining bans, and emerging trends.

One of Bitcoin’s most innovative features is its fixed supply cap of 21 million coins, which creates scarcity and drives value. The mining incentive decreases over time through halving events, which cut block rewards in half approximately every four years. This mechanism ensures controlled inflation and long-term sustainability. For those looking to dive deeper, Bitcoin mining courses and books offer structured learning, while the Bitcoin mining forum discussions often highlight practical tips, such as optimizing energy usage or selecting the right mining pool. Despite challenges like mining profit volatility and regulatory scrutiny, Bitcoin’s decentralized nature and robust design keep it at the forefront of the cryptocurrency revolution.

The crypto exchange ecosystem plays a crucial role in Bitcoin’s functionality, providing liquidity and enabling seamless trading. High trading volume on these platforms reflects Bitcoin’s widespread adoption, though users must stay informed about market dynamics and security best practices. Whether you're a miner, investor, or enthusiast, understanding how Bitcoin works—from its consensus mechanism to its economic model—is essential for navigating the rapidly evolving digital asset landscape.

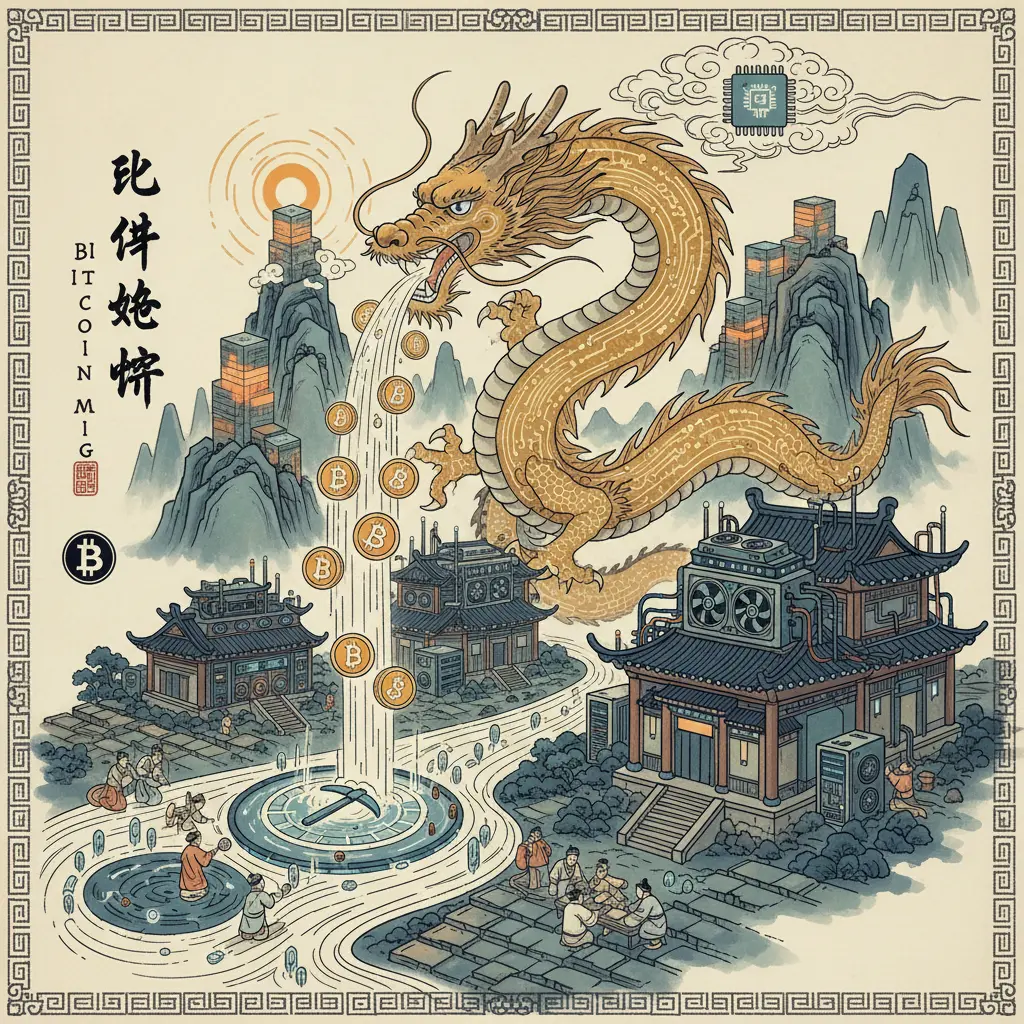

Professional illustration about Bitcoin

Bitcoin Mining Explained

Bitcoin Mining Explained

Bitcoin mining is the backbone of the Bitcoin network, ensuring security, transparency, and decentralization through Proof of Work (PoW). At its core, mining involves solving complex mathematical puzzles to validate transactions and add them to the blockchain. Miners compete to solve these puzzles, and the first to succeed earns newly minted Bitcoin as a reward—currently 3.125 BTC per block as of 2025, following the latest halving event. This process not only incentivizes participation but also regulates the supply of Bitcoin, keeping it scarce and valuable.

The mining competition has intensified over the years, with large-scale operations like MicroStrategy investing heavily in mining infrastructure. However, individual miners can still participate by joining Bitcoin mining communities on platforms like Discord or Facebook, where they share tips on optimizing mining profit. One key factor affecting profitability is mining cost, which includes electricity expenses, hardware efficiency, and energy consumption. For example, miners in regions with cheap electricity (like Texas or Scandinavia) often outperform those in areas with high energy costs.

Mining regulations and mining bans have also shaped the industry. Countries like China banned Bitcoin mining in 2021 due to environmental concerns, while others, like the U.S., have embraced it with clear mining tax policies. The debate over energy consumption remains heated, but innovations like renewable energy-powered mining farms are addressing these concerns. For those interested in learning more, Bitcoin mining courses and Bitcoin mining books provide in-depth knowledge on hardware setups, pool selection, and mining revenue calculations.

Tools like Bitcoin Mining Alert and Bitcoin Mining Analysis software help miners track performance and adjust strategies in real-time. Many miners also rely on Bitcoin Core, the official software, to stay synced with the network. Whether you're a hobbyist or a professional, engaging with the Bitcoin mining forum or subscribing to a Bitcoin mining feed can keep you updated on the latest trends, from ASIC advancements to shifts in trading volume affecting profitability.

Ultimately, Bitcoin mining is both a technical challenge and a financial opportunity. By understanding mining incentives, staying informed through Bitcoin mining blogs, and leveraging community insights, miners can navigate this dynamic space effectively—even as the landscape evolves in 2025 and beyond.

Professional illustration about Bitcoin

Bitcoin vs. Altcoins

Bitcoin vs. Altcoins: The Battle for Dominance in 2025

When it comes to cryptocurrency, Bitcoin remains the undisputed king, but altcoins continue to challenge its dominance with innovative features and lower mining costs. While Bitcoin relies on Proof of Work (PoW)—a secure but energy-intensive consensus mechanism—many altcoins have adopted alternatives like Proof of Stake (PoS) to reduce energy consumption and appeal to eco-conscious investors. For example, Ethereum’s shift to PoS in recent years has significantly cut its carbon footprint, making it a strong competitor. However, Bitcoin’s mining revenue and mining incentives still attract major players like MicroStrategy, which continues to accumulate BTC as a long-term store of value.

One key advantage Bitcoin holds over altcoins is its mining community and infrastructure. Platforms like Bitcoin Mining Discord, Bitcoin Mining Forum, and Bitcoin Mining Feed provide miners with real-time updates, while resources like the Bitcoin Mining Book and Bitcoin Mining Course help newcomers navigate the complex world of Bitcoin mining analysis. Altcoins, on the other hand, often lack this level of organized support, leaving miners to rely on fragmented Bitcoin Mining Facebook groups or less active communities.

Mining competition is another area where Bitcoin outshines most altcoins. With its high trading volume and liquidity, Bitcoin mining remains profitable despite rising mining regulations and mining taxes in some regions. In contrast, smaller altcoins face volatility, making their mining profits unpredictable. For instance, a sudden mining ban in a major market can cripple an altcoin’s network, whereas Bitcoin’s decentralized blockchain ensures resilience against such shocks.

That said, altcoins aren’t without their strengths. Many offer faster transaction speeds and lower fees, making them more practical for everyday use. Some even integrate smart contracts, a feature Bitcoin’s Bitcoin Core protocol is still catching up with via layer-2 solutions like the Lightning Network. Additionally, altcoins often experiment with novel mining incentives, such as staking rewards, which can be more accessible than Bitcoin’s hardware-heavy mining process.

For investors and miners, the choice between Bitcoin and altcoins often comes down to risk tolerance. Bitcoin’s stability and widespread adoption make it a safer bet, especially with institutions like MicroStrategy doubling down on their holdings. However, altcoins present higher growth potential—if you’re willing to navigate their volatility. Tools like Bitcoin Mining Alert services can help miners stay ahead of market shifts, whether they’re focused on BTC or diversifying into altcoins.

Ultimately, the cryptocurrency landscape in 2025 is more dynamic than ever. While Bitcoin remains the gold standard, altcoins continue to push boundaries, forcing the industry to evolve. Whether you’re a miner, trader, or long-term holder, understanding the nuances of Bitcoin vs. Altcoins is crucial for making informed decisions in this fast-paced market.

Professional illustration about Bitcoin

Bitcoin Security Tips

Bitcoin Security Tips: Safeguarding Your Crypto in 2025

With Bitcoin’s trading volume hitting record highs in 2025, securing your holdings is more critical than ever. Whether you’re a long-term holder like MicroStrategy or an active trader, these Bitcoin security tips will help you mitigate risks like hacking, phishing, and regulatory pitfalls.

Use Bitcoin Core for Full Node Security

Running a Bitcoin Core full node not only strengthens the network but also enhances your privacy. By validating transactions independently, you avoid relying on third-party services that could be compromised. This is especially valuable in 2025 as mining regulations tighten globally, making decentralized verification a priority.

Enable Multi-Signature Wallets

Multi-signature (multisig) wallets require multiple approvals for transactions, adding an extra layer of protection. For example, a 2-of-3 setup could involve your hardware wallet, a trusted device, and a backup stored offline. This minimizes risks even if one key is exposed—a tactic endorsed by the Bitcoin mining community for securing large holdings.

Stay Alert to Phishing Scams

Scammers are increasingly targeting Bitcoin mining forums, Discord groups, and even fake Bitcoin mining alerts to steal credentials. Always verify URLs, enable two-factor authentication (2FA), and never share private keys or recovery phrases. In 2025, phishing attacks often mimic Bitcoin mining courses or "exclusive" investment opportunities—stay skeptical of unsolicited emails or social media DMs.

Monitor Mining-Related Threats

If you’re involved in Bitcoin mining, keep an eye on mining competition and energy consumption trends. Rising mining costs can squeeze profits, but they also attract malicious actors. Join a reputable Bitcoin mining Discord or follow a trusted Bitcoin mining blog to stay updated on threats like malware-infected mining software or fraudulent cloud-mining schemes.

Diversify Storage Solutions

Combine hot (online) and cold (offline) wallets based on your needs. For instance, keep a small amount in a hot wallet for daily transactions but store the bulk in a hardware wallet or paper wallet. Companies like MicroStrategy often use institutional-grade cold storage, but even individual investors can adopt similar strategies.

Understand Tax and Regulatory Risks

With mining taxes and Proof of Work debates escalating, compliance is key. Track your transactions meticulously using tools that align with 2025 mining regulations. For miners, this includes reporting mining revenue accurately and staying ahead of potential mining bans in your region.

Leverage the Bitcoin Mining Community

Engage with the Bitcoin mining feed on platforms like Facebook or specialized forums to share insights on mining profitability and security best practices. Collective knowledge helps identify emerging threats, such as fake Bitcoin mining books or Ponzi schemes disguised as mining incentive programs.

By implementing these strategies, you’ll not only protect your assets but also contribute to the broader security of the blockchain ecosystem. Remember: In the fast-evolving world of cryptocurrency, staying proactive is your best defense.

Professional illustration about Analysis

Bitcoin Wallet Guide

Choosing the Right Bitcoin Wallet in 2025: Security, Convenience, and Beyond

With Bitcoin's trading volume hitting new highs in 2025, securing your cryptocurrency starts with selecting the right wallet. Whether you're a long-term holder like MicroStrategy or an active trader, your wallet choice impacts security, accessibility, and even mining profitability if you're part of the Bitcoin mining community. Here's a breakdown of wallet types and key considerations:

Hot Wallets vs. Cold Wallets

- Hot wallets (software-based) are ideal for frequent transactions. Options like Bitcoin Core (a full-node wallet) offer robust security but require significant storage and bandwidth. Mobile or web-based wallets are lighter but prioritize convenience—perfect for tracking mining revenue or quick trades on crypto exchanges.

- Cold wallets (hardware or paper) are offline and hacker-resistant. They’re a must for large holdings, especially if you’re earning mining profits or holding long-term. Brands like Ledger and Trezor remain top picks, with 2025 models featuring enhanced blockchain integration.

Security First: Protecting Your Bitcoin

- Multi-signature support: Crucial for businesses or mining pools distributing rewards. Requires multiple approvals for transactions, reducing single-point failures.

- Seed phrase management: Write it down offline—never digitally. Even the Bitcoin mining Discord forums warn against screenshot backups.

- Regulation updates: With mining regulations tightening globally (e.g., potential mining bans in energy-restricted regions), ensure your wallet complies with local mining tax laws.

Mining-Specific Wallet Tips

If you’re active in Bitcoin mining, your wallet needs differ:

- Low-fee transactions: Mining payouts can be frequent. Choose wallets with dynamic fee adjustments to save on mining costs.

- Integration with mining software: Some wallets sync seamlessly with Bitcoin mining alerts or platforms like Bitcoin Mining Forum for real-time balance tracking.

- Energy consumption awareness: Proof of Work (PoW) mining still dominates in 2025. Wallets supporting mining incentive programs (e.g., green energy rewards) are gaining traction.

The Social Side: Wallets for the Community

Engaged miners often rely on wallets with built-in social features. For example:

- Bitcoin Mining Facebook groups frequently recommend wallets with tipping functions for community contributions.

- Bitcoin mining feeds (like those in Bitcoin Mining Blog platforms) may highlight wallets offering mining competition leaderboards or pooled reward distributions.

Final Pro Tips

- Test small transactions first, especially when switching wallets or after mining regulation changes.

- Regularly update your wallet software to patch vulnerabilities—mining security breaches often start with outdated apps.

- For deep dives, check the Bitcoin mining bookCrypto Custody 2025 or enroll in a Bitcoin mining course focused on wallet best practices.

Whether you're securing mining revenue or simply holding, your wallet is your Bitcoin’s first line of defense. Balance convenience with ironclad security, and always stay updated on blockchain trends—because in 2025, the crypto landscape evolves faster than ever.

Professional illustration about Bitcoin

Bitcoin Price Analysis

Bitcoin Price Analysis in 2025: Trends, Influences, and Key Metrics to Watch

The Bitcoin price in 2025 continues to be a hot topic among investors, miners, and traders, driven by a mix of macroeconomic factors, institutional adoption, and mining dynamics. As of mid-2025, Bitcoin’s price has shown resilience despite regulatory shifts, with MicroStrategy doubling down on its holdings and mining competition intensifying due to advancements in hardware efficiency. One of the critical drivers this year is the mining revenue landscape, where fluctuations in energy consumption costs and mining regulations directly impact profitability—and, by extension, market sentiment.

For traders, keeping an eye on trading volume spikes and crypto exchange liquidity is essential. For example, when Bitcoin Core updates roll out (like the recent Taproot upgrade optimizations), they often trigger short-term volatility followed by long-term stability. Meanwhile, the Bitcoin mining community remains a barometer for price trends. Platforms like the Bitcoin Mining Forum and Bitcoin Mining Discord are buzzing with discussions about mining incentives and how mining bans in certain regions (like recent restrictions in parts of Europe) could affect supply.

Here’s what’s shaping Bitcoin’s price action this year:

- Institutional Moves: Companies like MicroStrategy continue to accumulate Bitcoin, signaling confidence despite price dips. Their quarterly reports often correlate with market rallies.

- Mining Economics: With mining costs rising due to energy price volatility, miners are increasingly relocating to regions with cheaper renewables. This migration affects mining profits and, indirectly, sell pressure on Bitcoin.

- Regulatory Clarity: The U.S. SEC’s 2025 guidelines on cryptocurrency ETFs have reduced uncertainty, attracting more institutional capital. However, mining taxes in jurisdictions like Canada are squeezing smaller operators.

- Technical Indicators: On-chain data from Bitcoin Mining Analysis blogs highlights accumulation trends among long-term holders (LTHs), a bullish signal when paired with low exchange reserves.

For those diving deeper, resources like the Bitcoin Mining Book or Bitcoin Mining Course offer insights into how Proof of Work adjustments influence price stability. Meanwhile, social channels like Bitcoin Mining Facebook groups or Bitcoin Mining Feed updates provide real-time sentiment analysis—useful for timing entries or exits.

Pro Tip: Watch the mining difficulty adjustments. When difficulty drops (indicating miner capitulation), it often precedes price bottoms, as seen in early 2025. Conversely, spikes in mining revenue can foreshadow upward momentum. Tools like Bitcoin Mining Alert services track these shifts, giving traders an edge.

Ultimately, Bitcoin’s 2025 price hinges on both macro trends (like Fed rate cuts) and micro-factors (like blockchain activity). Whether you’re a miner monitoring mining incentives or a trader analyzing trading volume patterns, staying adaptive is key in this ever-evolving market.

Professional illustration about Bitcoin

Bitcoin Regulations 2025

Bitcoin Regulations 2025: Navigating the Evolving Landscape

The regulatory environment for Bitcoin in 2025 has become more complex, with governments worldwide tightening oversight while also recognizing its potential as a transformative financial asset. The Mining Regulation landscape, in particular, has seen significant shifts, with countries like the U.S. and the EU introducing stricter Energy Consumption standards for Bitcoin Mining operations. For instance, the Mining Ban in certain regions due to environmental concerns has forced miners to relocate to areas with renewable energy sources, such as hydroelectric power in Scandinavia or solar farms in Texas. This has sparked debates within the Bitcoin Mining Community about sustainability and long-term viability, especially as Mining Profit margins fluctuate with rising Mining Costs.

One of the most talked-about developments is the Mining Tax policies being rolled out globally. In 2025, the IRS has clarified that Bitcoin Mining Revenue must be reported as taxable income, and miners are required to track their Mining Incentive rewards meticulously. Companies like MicroStrategy, which have heavily invested in Bitcoin, are now advocating for clearer guidelines to avoid penalties. Meanwhile, the Bitcoin Core development team continues to emphasize decentralization, pushing back against proposals that could centralize control over the network.

For individual miners and small-scale operations, staying compliant means keeping up with local laws and leveraging tools like Bitcoin Mining Alert systems to monitor regulatory changes in real-time. Platforms such as the Bitcoin Mining Forum and Bitcoin Mining Discord channels have become invaluable for sharing updates on Mining Competition and best practices. Some miners are even turning to educational resources like a Bitcoin Mining Course or the Bitcoin Mining Book to understand the legal and technical nuances of operating in 2025’s stricter climate.

The Proof of Work consensus mechanism remains a focal point for regulators, with some countries pushing for alternatives due to its high energy demands. However, the Bitcoin Mining Analysis community argues that innovations in energy-efficient hardware and renewable integration are making the process more sustainable. For example, mining farms are now using AI-driven Bitcoin Mining Feed data to optimize energy usage and reduce costs.

On the social media front, the Bitcoin Mining Facebook groups and Bitcoin Mining Email newsletters are buzzing with discussions about how new regulations impact trading volume and market sentiment. While some fear overregulation could stifle innovation, others believe that clear rules will legitimize Bitcoin further, attracting institutional investors. The key for miners and traders alike is to stay informed, adapt quickly, and engage with the Bitcoin Mining Blog ecosystem to navigate this dynamic regulatory landscape successfully.

Professional illustration about Community

Bitcoin for Beginners

If you're new to Bitcoin, welcome to the world of cryptocurrency! Bitcoin is a decentralized digital currency that operates on a blockchain—a public ledger secured by Proof of Work (PoW). Unlike traditional money, Bitcoin isn’t controlled by banks or governments, making it a favorite for those who value financial independence. But how does it work? Let’s break it down.

First, Bitcoin mining is the backbone of the network. Miners use powerful computers to solve complex mathematical problems, validating transactions and adding them to the blockchain. In return, they earn newly minted Bitcoin—a process called mining revenue. However, mining isn’t as simple as it sounds. Mining competition is fierce, and mining costs (like electricity and hardware) can be high. Companies like MicroStrategy have invested heavily in Bitcoin, but individual miners often join Bitcoin mining communities (like Bitcoin Mining Discord or Bitcoin Mining Forum) to share tips and strategies.

Speaking of costs, energy consumption is a hot topic. Critics argue Bitcoin mining uses too much power, leading to mining bans in some regions. But advocates highlight innovations in renewable energy and more efficient mining hardware. If you’re curious about mining, start with a Bitcoin mining course or check out a Bitcoin mining blog for the latest trends. You’ll learn about mining incentives, mining profits, and how to navigate mining regulations and mining taxes in your area.

For those not interested in mining, you can still get involved by trading Bitcoin on a crypto exchange. Keep an eye on trading volume to gauge market activity. And if you want to understand Bitcoin’s technical side, explore Bitcoin Core—the software that powers the network. Many beginners find it helpful to subscribe to a Bitcoin mining feed or Bitcoin mining email for updates.

Whether you’re mining, trading, or just learning, remember: Bitcoin is volatile. Prices can swing wildly, so never invest more than you can afford to lose. Dive into the Bitcoin mining community, ask questions, and stay informed. The more you learn, the better you’ll navigate this exciting space.

Professional illustration about Bitcoin

Bitcoin Investment Risks

Bitcoin Investment Risks: What You Need to Know in 2025

Investing in Bitcoin comes with unique risks that every potential investor should thoroughly understand before diving in. One of the most significant risks is volatility—Bitcoin’s price can swing dramatically within hours, influenced by factors like regulatory news, Mining Competition, and macroeconomic trends. For example, when China imposed a Mining Ban in 2021, Bitcoin’s price plummeted, showing how geopolitical decisions can impact the market. Even in 2025, regulatory uncertainty remains a major concern, as governments worldwide grapple with how to classify and tax cryptocurrencies. The Mining Regulation landscape is still evolving, and sudden policy shifts can disrupt Mining Revenue and, by extension, Bitcoin’s stability.

Another critical risk is security. While Bitcoin itself is secure thanks to Proof of Work, investors must safeguard their holdings from hacks, scams, and phishing attacks. Stories of exchanges being compromised or individuals losing access to their wallets are common in the Bitcoin Mining Community. Even large players like MicroStrategy, which holds billions in Bitcoin, face scrutiny over their custodial practices. Self-custody solutions like hardware wallets can mitigate this risk, but they require technical know-how—something many casual investors lack.

Energy Consumption and environmental concerns also pose long-term risks. Bitcoin mining requires massive computational power, leading to criticism over its carbon footprint. In 2025, as climate policies tighten, miners may face higher Mining Costs due to carbon taxes or stricter Mining Incentive structures. This could squeeze profits and push smaller miners out of the market, further centralizing control among large players. Investors should monitor Bitcoin Mining Analysis reports to gauge how these shifts impact network health and profitability.

Lastly, liquidity risk is often overlooked. While Bitcoin is more liquid than most altcoins, extreme market conditions—like the 2022 crypto winter—can lead to frozen withdrawals or widened spreads on exchanges. Traders relying on crypto exchange platforms may find themselves unable to exit positions quickly during a crash. Diversifying across multiple exchanges and keeping some holdings in cold storage can help mitigate this risk.

For those considering Bitcoin as part of their portfolio, staying informed through resources like the Bitcoin Mining Forum or Bitcoin Mining Discord groups is crucial. Understanding the interplay between Mining Profit, trading volume, and macroeconomic trends will help investors navigate this high-reward but high-risk asset class. Always remember: never invest more than you can afford to lose.

Professional illustration about Bitcoin

Bitcoin Tax Guide

Understanding Bitcoin Taxes in 2025: What You Need to Know

Navigating Bitcoin taxes can feel overwhelming, but staying compliant is critical—especially with the IRS cracking down on cryptocurrency reporting in 2025. Whether you're trading, mining, or holding Bitcoin, here’s a breakdown of key tax considerations.

Taxable Events in Bitcoin Transactions

Every time you sell, trade, or spend Bitcoin, it’s considered a taxable event. For example, if you bought 1 BTC for $30,000 and later sold it for $50,000, you’d owe capital gains tax on the $20,000 profit. The same applies if you use Bitcoin to purchase goods or services—you’re effectively "selling" it at its current market value. Even swapping Bitcoin for another cryptocurrency (like Ethereum) triggers a taxable event.

Pro Tip: Keep detailed records of every transaction, including dates, amounts, and USD values at the time of the trade. Tools like Bitcoin Core or third-party crypto tax software can help automate this process.

Bitcoin Mining and Taxes

If you’re part of the Bitcoin mining community, your rewards are treated as income based on their fair market value when received. For instance, if you mine 0.1 BTC when the price is $40,000, you’d report $4,000 as ordinary income. Mining expenses (like hardware and electricity) can often be deducted, but regulations vary by jurisdiction. Some countries, like those with a mining ban, impose additional restrictions or taxes.

Example: A Bitcoin mining course might teach you how to calculate mining profit after accounting for mining costs like energy consumption. However, if your operation scales up, you may also face mining regulation compliance, such as reporting revenue to the IRS.

Corporate Bitcoin Holdings (Like MicroStrategy)

Companies like MicroStrategy, which holds billions in Bitcoin, face unique tax implications. While buying and holding Bitcoin doesn’t trigger taxes, selling or using it for business expenses does. Corporations must also account for Bitcoin’s volatility in financial reporting, which can impact shareholder taxes.

Staying Ahead of Mining-Specific Rules

The Bitcoin mining Discord and Bitcoin mining forum are great places to discuss evolving tax policies. For example, some regions now require miners to report mining revenue quarterly, while others tax mining incentives like block rewards differently than transaction fees.

Key Takeaway: Consult a tax professional familiar with blockchain and cryptocurrency laws. The rules are complex, especially with mining competition driving tighter regulations worldwide.

Final Notes

- Proof of Work energy consumption may lead to additional carbon taxes in some areas.

- Trading volume can affect short-term vs. long-term capital gains rates.

- Joining a Bitcoin mining Facebook group or subscribing to a Bitcoin mining email feed can help you stay updated on tax changes.

By understanding these nuances, you can avoid surprises at tax time and maximize your mining profit while staying compliant.

Professional illustration about Bitcoin

Bitcoin Future Outlook

Bitcoin's future outlook remains a hot topic in 2025, with debates ranging from its adoption as a global reserve asset to the sustainability of Bitcoin mining under evolving regulations. Companies like MicroStrategy continue to double down on their BTC holdings, signaling strong institutional confidence despite market volatility. Meanwhile, the Bitcoin mining community faces both challenges and opportunities—rising mining competition and energy consumption concerns clash with innovations in renewable energy integration and more efficient Proof of Work mechanisms.

One critical factor shaping Bitcoin's trajectory is mining regulation. Countries like the U.S. and Germany are tightening mining tax policies, while others impose partial mining bans due to environmental pressures. However, the Bitcoin mining industry is adapting. For example, mining farms are relocating to regions with cheaper, cleaner energy, and startups are launching Bitcoin mining courses to educate newcomers on sustainable practices. Platforms like the Bitcoin Mining Forum and Bitcoin Mining Discord serve as hubs for sharing real-time Bitcoin mining analysis, helping miners optimize mining revenue amid fluctuating mining costs.

The Bitcoin Core development team is also pivotal, with upgrades aimed at improving scalability and reducing transaction fees. This could further boost trading volume on major crypto exchanges, reinforcing Bitcoin's dominance. Meanwhile, tools like Bitcoin Mining Alert systems and Bitcoin Mining Feed services keep miners ahead of network difficulty adjustments and profitability shifts. For those diving deeper, the Bitcoin Mining Book ecosystem offers advanced strategies, from hardware selection to hedging against mining profit volatility.

Social media plays a role too. The Bitcoin Mining Facebook groups and Bitcoin Mining Email newsletters disseminate breaking news, like China's recent reversal on its mining crackdown or El Salvador's new geothermal-powered mining initiative. These updates highlight how geopolitical and technological shifts influence mining incentives.

Looking ahead, Bitcoin's future hinges on balancing innovation with regulation. Will blockchain purists resist moves toward hybrid Proof of Work models? Can the network maintain decentralization as mining competition concentrates among industrial-scale operators? One thing’s clear: the Bitcoin mining community must stay agile—whether through adopting AI-driven efficiency tools or lobbying for fairer mining regulations. For investors and miners alike, staying informed via Bitcoin mining blogs and analytics platforms will be key to navigating the next phase of crypto evolution.

Professional illustration about Facebook

Bitcoin Transaction Fees

Bitcoin Transaction Fees in 2025: What You Need to Know

In 2025, Bitcoin transaction fees remain a hot topic for investors, miners, and everyday users. With the cryptocurrency’s growing adoption, fees fluctuate based on network congestion, trading volume, and Bitcoin mining dynamics. Unlike traditional banking fees, Bitcoin fees aren’t fixed—they’re determined by market demand and the Proof of Work mechanism. For example, when MicroStrategy executes large BTC purchases, the network often sees a spike in fees due to increased activity.

How Fees Work and Why They Matter

Every Bitcoin transaction competes for space in the next block, and users can prioritize theirs by offering higher fees. Miners—who validate transactions—naturally prioritize those with higher incentives, as their mining revenue depends on it. In 2025, tools like Bitcoin Mining Alert and Bitcoin Mining Analysis platforms help users estimate optimal fee rates in real-time. For context, a simple transfer might cost a few dollars during low-traffic periods, but complex transactions (like those involving smart contracts) can escalate fees significantly.

The Role of Bitcoin Core and Mining Communities

The Bitcoin Core development team continuously optimizes fee structures to balance speed and cost. Meanwhile, the Bitcoin Mining Community plays a crucial role—miners decide which transactions to include, and their mining profit hinges on fee selection. Forums like the Bitcoin Mining Forum and Discord groups (e.g., Bitcoin Mining Discord) often discuss strategies to minimize fees, especially during bull markets when the network is congested.

Regulatory and Environmental Impacts

With stricter mining regulations in some regions, energy consumption concerns have led to debates about fee sustainability. Countries imposing partial mining bans have inadvertently increased mining competition elsewhere, indirectly affecting fees. Additionally, mining taxes in jurisdictions like the U.S. and EU have pushed miners to prioritize higher-fee transactions to offset costs.

Practical Tips for Users

- Monitor fee trends: Use Bitcoin Mining Feed or Bitcoin Mining Blog updates to time your transactions during low-activity windows.

- Batch transactions: Services like crypto exchanges often combine smaller transfers to reduce per-transaction costs.

- Adjust fee settings: Wallets with dynamic fee calculators (based on Bitcoin Mining Course principles) can help avoid overpaying.

Looking Ahead

As blockchain scalability solutions like the Lightning Network gain traction, Bitcoin fees may stabilize further. However, for now, understanding the interplay between mining incentives, network demand, and external factors remains key to cost-effective transactions in 2025. Whether you’re a miner checking Bitcoin Mining Email alerts or a trader analyzing trading volume, staying informed ensures you’re not caught off guard by sudden fee spikes.

Professional illustration about Bitcoin

Bitcoin Privacy Features

Bitcoin is often perceived as an anonymous cryptocurrency, but in reality, it operates on a transparent blockchain where every transaction is publicly recorded. However, several built-in and third-party privacy features enhance confidentiality for users who prioritize discretion.

Pseudonymity vs. Privacy

Unlike traditional banking, Bitcoin transactions don’t require personal identification, relying instead on cryptographic addresses. However, since the blockchain is open, sophisticated analysis (like Bitcoin Mining Analysis) can sometimes link addresses to real-world identities. For improved privacy, tools like CoinJoin (implemented in wallets like Wasabi and Samourai) mix transactions from multiple users, obscuring the trail. Additionally, the Bitcoin Core software supports features like Tor integration to mask IP addresses during transactions.

Taproot and Schnorr Signatures

The 2021 Taproot upgrade introduced Schnorr signatures, which improve privacy by making complex transactions (e.g., multisig) indistinguishable from regular ones. This reduces metadata leakage, a common issue in earlier Bitcoin transactions. Miners (Bitcoin Mining Community) benefit too, as Schnorr signatures optimize block space, indirectly lowering Mining Costs.

Privacy Challenges and Solutions

While Bitcoin Mining itself doesn’t directly impact privacy, mining pools (Bitcoin Mining Discord, Bitcoin Mining Forum) can inadvertently expose transaction patterns. Users can mitigate this by avoiding address reuse and leveraging Hierarchical Deterministic (HD) wallets to generate new addresses for each transaction. Services like PayJoin further obscure transaction links by allowing sender and receiver to collaborate on a single transaction, complicating blockchain analysis.

Regulatory and Competitive Pressures

Mining Regulations and Mining Taxes vary globally, with some governments pushing for stricter KYC rules on exchanges (crypto exchange). This pressures privacy-focused developers to innovate while balancing compliance. Meanwhile, MicroStrategy and institutional players often prioritize transparency, creating a tug-of-war between privacy advocates and corporate adoption.

Future of Bitcoin Privacy

Advances like Confidential Transactions (CT) and Dandelion++ (which obfuscates transaction propagation) are in development. However, broader adoption depends on balancing privacy with scalability—a key concern for Mining Profit and Proof of Work* sustainability. For everyday users, combining tools like VPNs, hardware wallets, and privacy-centric wallets remains the best practice.

Professional illustration about Bitcoin

Bitcoin Adoption Growth

Bitcoin Adoption Growth continues to accelerate in 2025, driven by institutional interest, regulatory clarity, and technological advancements. Companies like MicroStrategy remain at the forefront, with their latest quarterly reports revealing additional Bitcoin purchases, reinforcing confidence in BTC as a long-term store of value. The growing acceptance of Bitcoin as a payment method by major retailers and service providers further underscores its mainstream adoption. For instance, recent partnerships between crypto exchanges and global payment processors have made it easier than ever for businesses to integrate Bitcoin transactions seamlessly.

The Bitcoin mining ecosystem has also evolved significantly, with miners adapting to stricter mining regulations and shifting energy dynamics. While some regions have imposed mining bans due to environmental concerns, others are leveraging renewable energy sources to sustain operations profitably. The mining competition has intensified, pushing miners to optimize efficiency through advanced hardware and strategic location choices. Mining revenue remains a hot topic, especially with the 2024 halving event now in the rearview mirror, forcing miners to innovate or risk shrinking profit margins. Platforms like the Bitcoin Mining Forum and Bitcoin Mining Discord communities are buzzing with discussions on cost-cutting strategies and emerging technologies like immersion cooling.

Educational resources are playing a pivotal role in adoption, with Bitcoin Mining Courses gaining popularity among newcomers eager to understand Proof of Work mechanics. Meanwhile, Bitcoin Mining Blogs and Bitcoin Mining Books offer deep dives into topics like mining incentives and energy consumption, helping both hobbyists and professionals stay informed. Social media channels, including Bitcoin Mining Facebook groups and Bitcoin Mining Feed updates, keep the community engaged with real-time insights on mining profits and regulatory changes. Even niche platforms like the Bitcoin Mining Email newsletters provide tailored analysis, catering to miners who prefer curated content over sifting through forums.

From an investment perspective, the rise of blockchain analytics tools has made it easier to track trading volume and market trends, attracting more institutional players. The cryptocurrency market’s maturation is evident in the growing number of crypto exchanges offering sophisticated derivatives and custody solutions. However, challenges like mining taxes and geopolitical uncertainties still loom, requiring stakeholders to stay agile. Whether you're a miner, trader, or simply a Bitcoin enthusiast, staying active in the Bitcoin Mining Community is crucial for navigating this rapidly evolving landscape.